Social Media Finfluencers – Who Should You Trust?

Think Kim Kardashian has the answers about personal finance? You might want to think twice before taking her advice. People on social platforms continue to influence how Americans make financial decisions as more people turn to them for help. According to a study by TIAA, a third of all new investors use social media to research investment ideas. Thirty-two percent of those investors also say they trust social media influencers and celebrities’ financial advice.

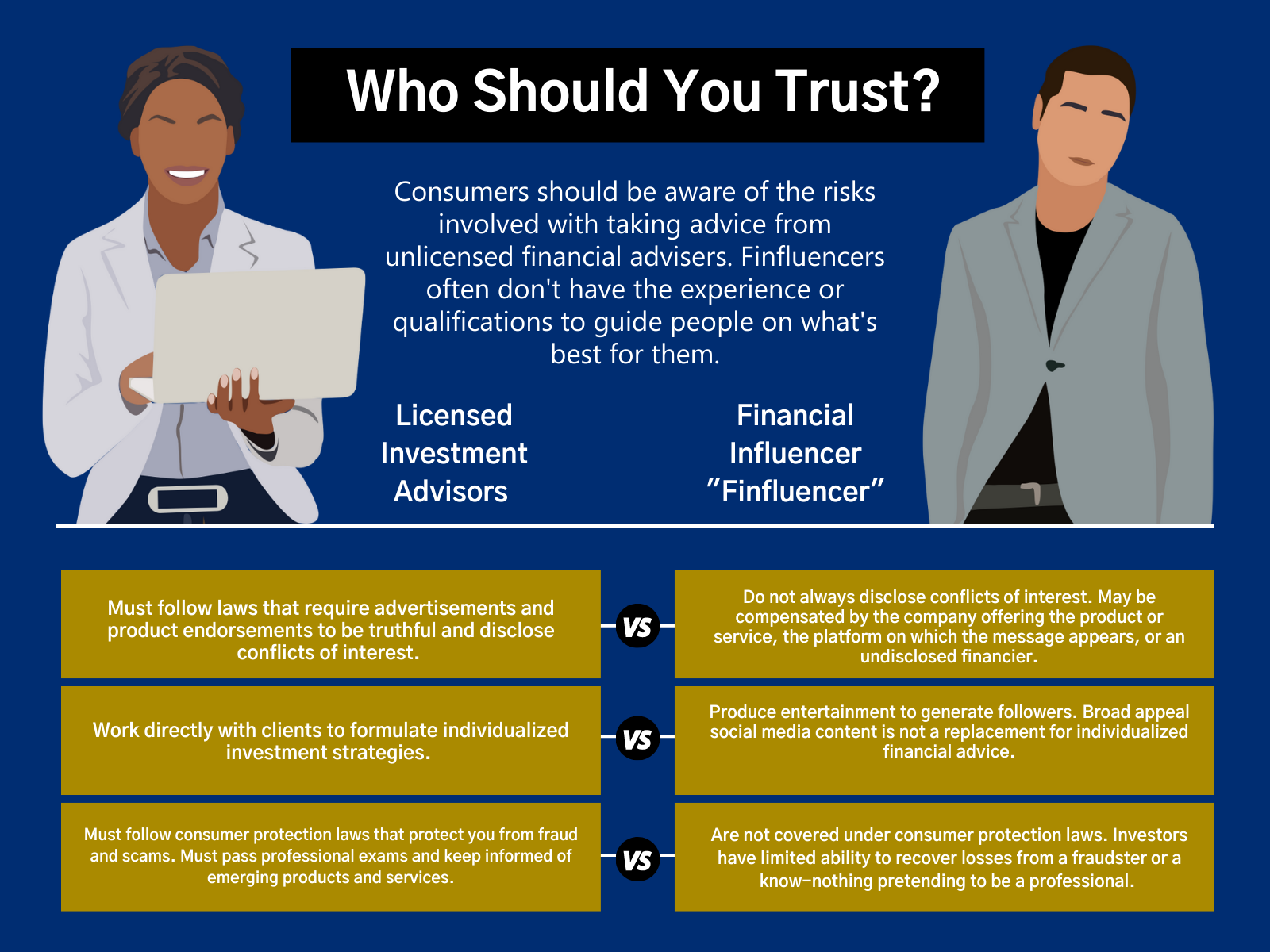

Many Millennials and Gen Z-ers are using social media sources for information about investing rather than relying on more traditional sources such as brokerage or investment advisory firms. Influencers have taken notice and social media has become saturated with financial content. However, consumers should be aware of the risks involved with taking advice from unlicensed financial advisers. Financial influencers or “finfluencers” often don’t have the experience or qualifications to guide people on what’s best for them.

Consumers should be aware of the risks involved with taking advice from unlicensed financial advisers. Financial influencers or “finfluencers” often don’t have the experience or qualifications to guide people on what’s best for them.

For example, Kim Kardashian recently agreed to pay a $1.26 million settlement with the SEC for promoting crypto security EMAX on her Instagram account without disclosing she was paid $250,000 to do so. EMAX has fallen by more than 99 percent since peaking in May 2021. This case is a reminder that, when celebrities or influencers endorse investment opportunities, it doesn’t mean those investment products are right for all investors or that they are even legitimate.

Additionally, access to licensed and certified financial advisors is often out of reach for many. Marginalized and underrepresented communities of color often prefer people who understand and respect the nuances of their culture, so finfluencers fill in the gap as they are often better able to understand the needs of those clients. As financial exploitation continues to be a growing concern, particularly with young adults and elderly investors, consumers need to know how to spot red flags and how to protect themselves when seeking financial advice on social media platforms and apps.

What is a Finfluencer?

A finfluencer is a person who, by virtue of their popularity or cultural status, can influence the financial decision-making process of others through promotions or recommendations on social media. They may influence potential buyers by publishing posts or videos to their social media accounts, often stylized to be entertaining so that the post or video will be shared with other potential buyers. While there is nothing new about marketers paying for celebrity endorsements, what is different is that such breezy and hyper-emotional endorsements are being made in what is otherwise a very regulated industry with stringent rules about performance claims and disclosure of potential conflicts of interest.

There are several differences between finfluencers and licensed investment advisors, but here are a few things to consider when evaluating the source of online financial advice.

Watch Out for Red Flags

While celebrities and other well-known personalities may be very talented in their respective professions, that doesn’t necessarily mean they are a trusted source for investment advice. Before emotionally and financially investing in social media personalities, watch out for these red flags:

- Dubious Advice – While some financial content may include helpful advice like the basics of financial literacy, other content might include reckless advice (e.g., “Avoid Paying Your Debts” or “Avoid Making Your Next Mortgage Payment Using this HACK!”) which could result in serious consequences, including a lowered credit score, losing significant amounts of money, or civil or criminal actions being brought against you. If it sounds too good to be true, it probably is.

- Free Offers – Free is never free. Before investing, look for hidden fees and ask for payment commitments in writing.

- Booklets or Training Courses – Beware of purchasing repurposed and outdated investment strategies that offer lofty promises. There’s no need to purchase courses or e-books containing information you can find online for free.

- A Sense of Urgency – Some finfluencers use scare tactics or pressure to manipulate you into investing or paying up-front for a service that hasn’t been performed. If you experience this or simply feel anxiety while interacting with a finfluencer, it is most likely a scam. Before making an investment, end your discussion and seek the advice of a trusted friend, family member, or licensed investment advisor before taking an action you may regret.

- FOMO or “Fear of Missing Out” – Do you have a strong urge to be on the forefront of something “new” or want to be “the first” to be involved with a new product? The stream of information on social media tends to build fear of being left behind by others who have claimed wealth from speculative investments. Don’t buy into the hype.

- Peer Pressure – Do you feel pressured to invest in order to be “friends” with the finfluencer or feel like you “belong” to their online community? The bottom line is unless you know them personally, finfluencers are not your friends. And your money is your money. Take control by doing your own independent research and consulting with a licensed professional financial advisor.

How to Protect Yourself:

Investing is an individualized endeavor where success looks different for everyone. Endorsements for financial products should be treated with skepticism and subjected to the same scrutiny and consideration given to any other major business decision. Before investing with a finfluencer, consider the following strategy:

- Credentials Check – If the finfluencer claims to hold a financial certification or designation of any kind, check to see if the certification or designation comes from an accredited organization and if they are currently in good standing.

- Show Me the Data – Some finfluencers build their following by promising “to the moon” stock picks or investment strategies on a regular basis. If they only promote their amazing results, they are likely too good to be true. Ask for the data to back up their claims.

- Do Your Research – Before investing, do your own independent research outside of taking advice from a finfluencer. It is problematic to take advice from unlicensed financial advisors, especially if they are targeting you for scams or fraud.

- Only Invest Money You Can Afford to Lose – When considering investments in crypto assets or other types of high-risk investment products or services, never pay in cash and never take out a loan to pay for an investment. If your investment goes bad, you’ll have no recourse to reclaim your payments, or worse, you’ll be stuck paying off a debt for a worthless asset.

- Keep Records – It’s important to keep thorough records on who you are investing with, including their full legal name, affiliate organization, and contact information, and how much money you are investing and on what dates. Should you get into trouble, this information will be helpful to file a complaint or to try to get your money back.

Where to Go for Help

The DFPI urges consumers to exercise extreme caution before responding to any solicitation offering financial services or investments. The DFPI licenses investment advisors, they do not license finfluencers or the crypto asset products and services they often promote. These products and services are currently not insured or regulated and are considered very high risk. If you lose your investment or get locked out of your account, there may be no options available to recover your losses. To check a finfluencer’s license status or if any actions have been taken against them, visit the DFPI’s Check Out Your Investment Adviser Webpage.

For questions or inquiries, contact the DFPI at Ask.DFPI@dfpi.ca.gov or call toll-free at (866) 275-2677. If you believe a finfluencer has violated state law or acted improperly regarding a financial product or service, you may file a formal complaint on the DFPI’s File a Complaint Webpage.