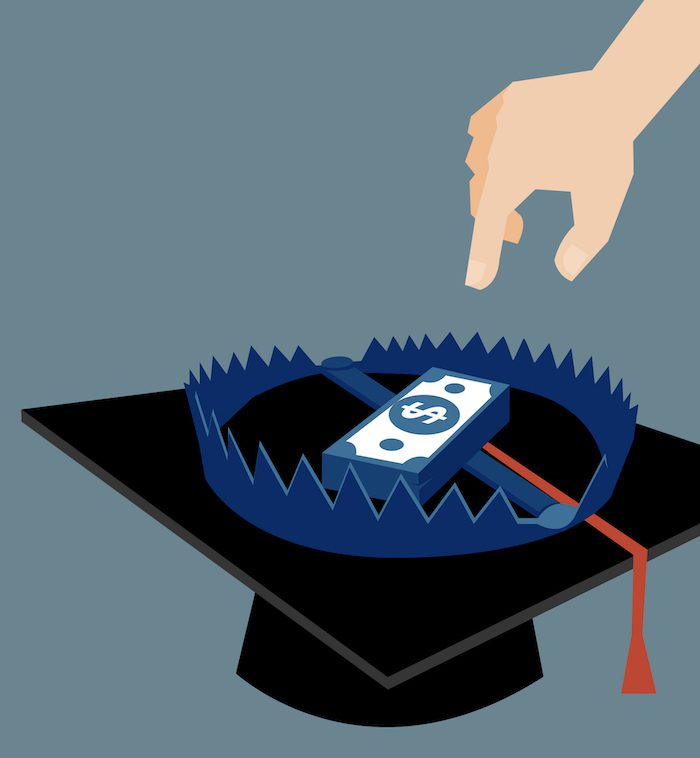

Don’t Fall Victim to Student Debt Relief Scams

Every year, thousands of Americans are contacted by student loan debt relief companies via mail and email. These companies purport to help student loan borrowers manage or reduce their student loan repayment for a fee. However, many of these companies are charging fees for services that your federal loan servicer provides for free or that you can complete on your own.

So-called student debt relief companies claim that they can get your student loans forgiven and that they can help you avoid default by reviewing your loan files, negotiating with your lenders, and submitting an application on your behalf for student loan forgiveness. They may even have correct information about you or your loan balance, giving the impression that they are legitimate.

The law, however, prohibits these companies from acting in unlawful, unfair, deceptive, or abusive ways, and the Department of Financial Protection and Innovation is here to help you.

Know Your Rights:

Federal student loan servicers cannot charge you to apply for loan forgiveness, income-driven repayment plans, deferment, forbearance, or to file any other paperwork. Federal student loan servicers do not charge any application or processing fees to consolidate your federal loans or to switch payment plans.

You should never have to pay for information about how to repay your student loans. Federal student loan borrowers can access free assistance through the U.S. Department of Education (studentaid.ed.gov or 877-557-2575) or your federal loan servicer—the company to which you make payments.

Only the U.S. Department of Education can consolidate, forgive, or lower the amount you pay on federal student loans. And remember, it is always free to work with your loan servicer or the federal government directly to change your repayment terms, if needed.

Consolidating federal student loans into a private loan will make you ineligible for federal income-driven repayment plans and for some federal loan forgiveness options, including the Public Service Loan Forgiveness program (PSLF).

You have a right to file a complaint. If a company violates any of your rights, you may file a complaint with the DFPI, the California Attorney General’s Office, the Consumer Financial Protection Bureau, or the Federal Trade Commission.

Tips for Identifying Student Loan Debt Relief Scams

The DFPI encourages consumers to exercise extreme caution before responding to any solicitation about student loan services. Be especially careful if a person or company:

- Sends an unsolicited telephone call, email, or letter in the mail claiming that you may be eligible for student loan forgiveness. Sometimes these communications can seem unusually personal. For example, the caller or sender of the email/letter may know specific information about the total balance of your student loans.

- Promises immediate or fast student loan debt forgiveness or cancellation or that it will help you fix a default on your loans.

- Requests your Federal Student Aid log-in and PIN. The U.S. Department of Education and your federal student loan servicer will never contact you via phone or e-mail seeking this information.

- Has “federal,” “national,” or other official-sounding words in its name or claims that it is affiliated with the U.S. Department of Education or other government agency.

- Demands payment upfront to apply for student loan forgiveness. Usually, these fees are paid in multiple large payments, or as smaller monthly payments.

- Insists you only have a few days or weeks to apply for the company’s services or you will lose out on the opportunity to apply for forgiveness or forbearance.

- Requires you to sign a contract with the company for their services and demands payment authorization. The contract may also require you to sign a power of attorney form authorizing the company to speak to your student loan servicers on your behalf.

- Tells you to cut off communications with your loan servicer. If someone urges you to make payments to their company instead of your loan servicer or to stop communicating with your loan servicer, do not give them any information. Do not stop making payments to your servicer unless they tell you to.

- Uses an e-mail address or website that does not end with “.gov”.

- There are typos in the sender’s email address and the emails you receive.

Resources for Borrowers

Loan Servicer Lookup

Check to find out if a student loan servicer or financial service provider is licensed in California:

- Directory of Student Loan Servicers – Licensed and Non-licensed covered by the California Department of Financial Protection and Innovation

- Look up Student Loan Servicers nationwide – NMLSconsumeraccess.org

If you can’t find your servicer or still need help, contact the DFPI for questions or inquiries at ASK.DFPI@dfpi.ca.gov or call toll-free at (866) 275-2677.

File a Complaint

If you have received a communication from a student loan debt relief company with your personal information in it, or if you have been a victim of a scam, you can file a complaint at https://dfpi.ca.gov/file-a-complaint, or contact us with questions or issues by emailing Ask.DFPI@DFPI.ca.gov or calling 1-866-275-2677. Federal Trade Commission (FTC) – Information and guidance to spot scams related to student loan debt relief. Consumer Financial Protection Bureau (CFPB) – Consumer advisory and information about recognizing student loan scams. U.S. Department of Education Office of Federal Student Aid – How to avoid student loan forgiveness scams and information on income-based repayment plans for student loan borrowers.